Mitsubishi Research Institute enables Joyo Bank to unlock advanced, accessible data analysis with OVHcloud Data Platform

OVHcloud & Mitsubishi Research Institute

Easier data preparation and processing in data analysis

Facilitated modelling in various departments and business units

Secure user management and multi-factor authentication

The context

Mitsubishi Research Institute, Inc. (MRI) now supports Joyo Bank, Ltd., with OVHcloud Data Platform and the financial retail application, ForeRetail.

The challenge

As society becomes more digital, the way people use financial institutions is changing at a fast pace. Financial institutions are now expected to tailor their services to individual life changes and daily needs of customers, using the most effective touchpoints for each user.

To help achieve this, MRI has been supporting the advancement of data-driven marketing, offering consulting for one-to-one marketing*, providing AI models, and developing related systems. As part of this project, MRI has begun providing Joyo Bank with the data platform, OVHcloud Data Platform, and the financial retail application, ForeRetail.

*One-to-one marketing: a marketing method in which financial institutions use customer data—such as demographic attributes and behavioural history—to deliver personalised, timely, and relevant messages through the most suitable channels for each customer.

The solution

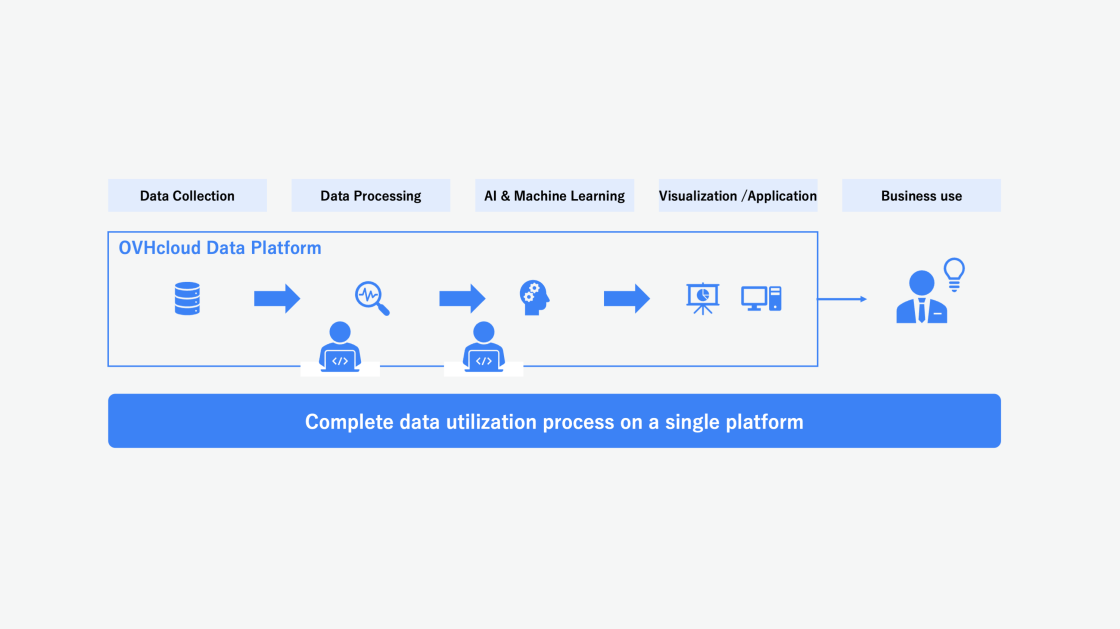

OVHcloud Data Platform is a full-featured platform that includes all the essential tools for effective data management, such as collection, processing, visualisation, and application development, via AI modelling and machine learning.

Data management with OVHcloud Data Platform

Compiled by Mitsubishi Research Institute, Inc.

Joyo Bank is committed to a “data democratisation” strategy that enables each department to autonomously access and leverage data. OVHcloud Data Platform streamlines data preparation and processing in data analysis and marketing projects, and facilitates AI modelling across a wide range of departments and business units.

Furthermore, because OVHcloud Data Platform archives past analyses and results, bank employees can easily share and build on each other’s work, improving the organisation’s knowledge base.

Besides fostering this type of work environment, Joyo Bank is also cultivating digital transformation (DX) talent through statistical training. This will empower data-driven employees to act quickly, and help ensure the successful adoption and integration of the Platform.

OVHcloud Data Platform’s features include user management, multi-factor authentication, and data management capabilities to control data access and visibility. This eliminates the common issues seen in data projects, such as inconsistent interfaces across various tools, or complex IT asset management linked to using multiple products.

It is worth noting that OVHcloud Data Platform’s application extends beyond financial institutions—it can be used for data analysis in a wide variety of industries.

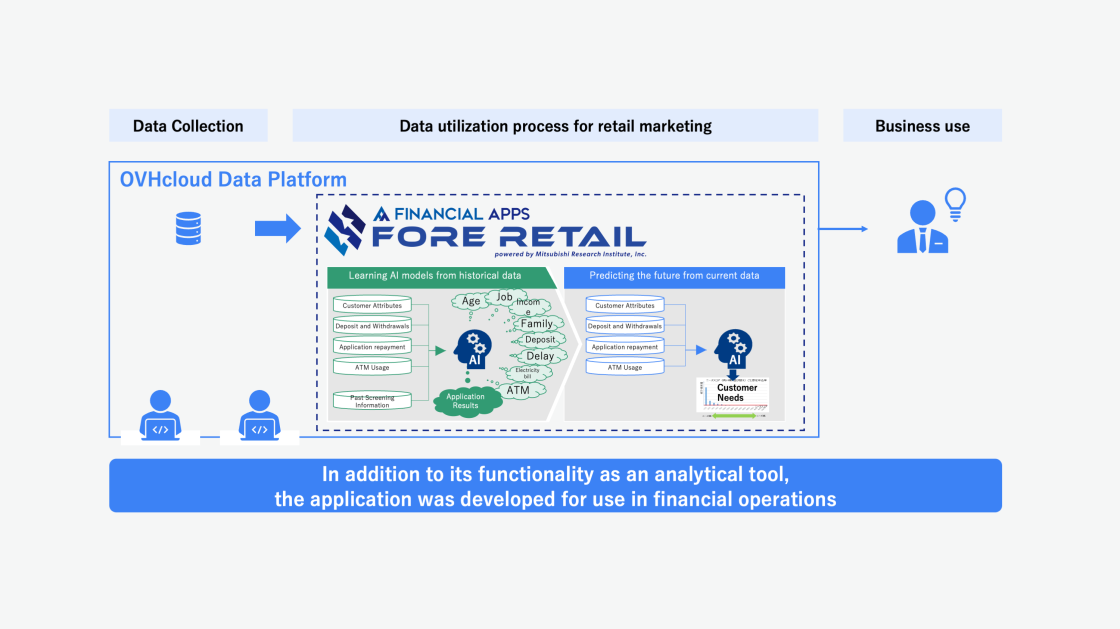

ForeRetail is a finance application specialising in marketing retail financial services. It is based on MRI’s proprietary retail marketing model (patented), and was developed using the capabilities of OVHcloud Data Platform, then offered as an application.

Business processes in ForeRetail

Compiled by Mitsubishi Research Institute, Inc.

Using the application, Joyo Bank employees can access both internal bank data and MRI’s financial consulting expertise. This allows individual bankers to autonomously use AI to analyse and forecast each customer’s needs as regards future retail financial products. They can also use a trial-and-error approach, based on customers’ life changes, to provide more effective and efficient product recommendations.

The result

MRI plans to continue expanding its range of services by combining OVHcloud Data Platform’s capabilities with its years of expertise supporting financial institutions. MRI aims to contribute, through these efforts, to the digital transformation (DX), operational efficiency, and advancement of financial institutions, while also supporting sustainable customer growth.